Sensex scales Mt 64k on bull run

Dalal St sets new records as Nifty climbs 19,000-peak in intra-day trade on unabated FPI inflows; Hectic buying in RIL, HDFC Bank and Infosys further supported key indices

image for illustrative purpose

Mumbai Equity benchmark indices hit their lifetime highs on Wednesday, with Sensex reaching the record 64,000 mark and Nifty scaling the 19,000 level in intra-day trade, as fresh foreign fund inflows and a rally in the US and European markets bolstered investor sentiments. Hectic buying in market heavyweights Reliance Industries, HDFC Bank and Infosys added to the positive momentum, traders said.

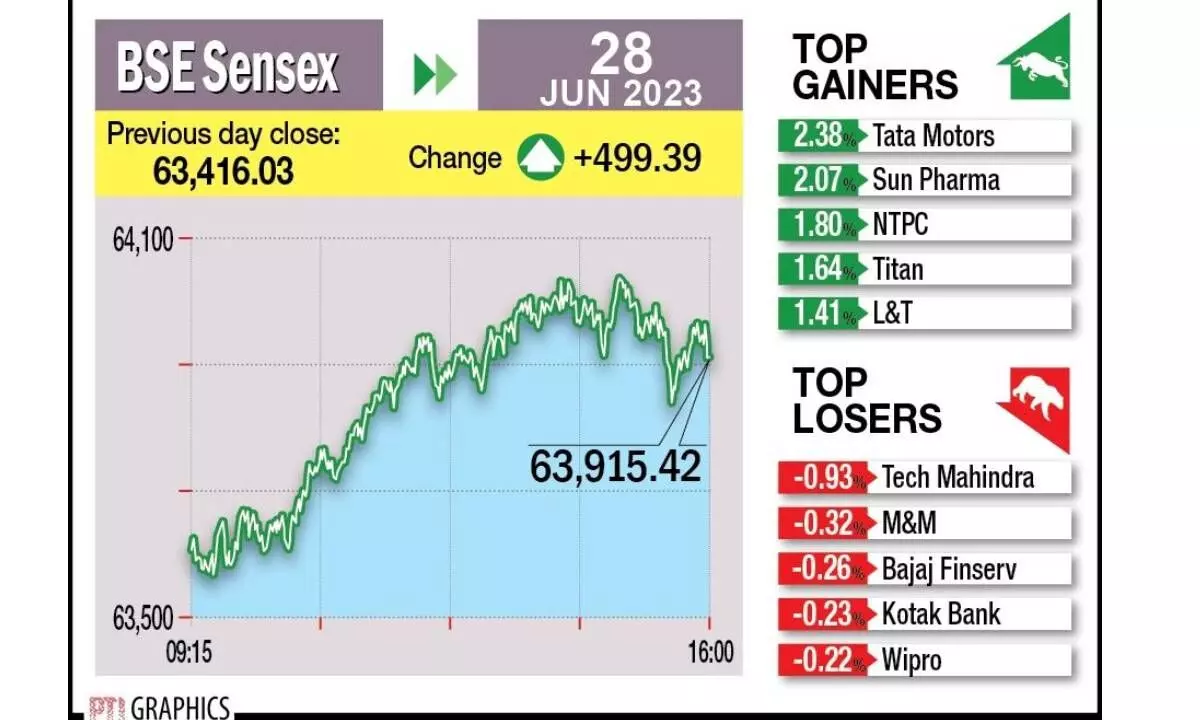

Extending the previous day’s rally, the 30-share BSE Sensex surged 499.39 points or 0.79 per cent to settle at its lifetime closing high of 63,915.42. During the day, the index jumped 634.41 points or 1 per cent to hit its all-time intra-day peak of 64,050.44. Likewise, the NSE Nifty climbed 154.70 points or 0.82 per cent to end at a record high of 18,972.10 points. It zoomed 193.85 points or 1 per cent to reach its lifetime intra-day high of 19,011.25 during the session.

Tata Motors was the biggest gainer in the Sensex pack, rising 2.38 per cent, followed by Sun Pharma, Titan, Larsen & Toubro, IndusInd Bank, Reliance Industries, NTPC, UltraTech Cement, Bajaj Finance, Infosys, HDFC Bank and Maruti. In contrast, Tech Mahindra, Mahindra & Mahindra, Kotak Mahindra Bank, Bajaj Finserv, HCL Technologies and Wipro were the laggards.

“After almost a seven-month consolidation, the Nifty has surpassed the 19,000 mark, and what’s more, all sectors are in the green as well. Investors are massively turning positive on risk assets, taking comfort from the recent fall in inflation, anticipating the end of the rate hike cycle,” said Amar Ambani, Group President & Head - Institutional Equities at Yes Securities.

In the broader market, the BSE midcap gauge climbed 0.73 per cent and smallcap index gained 0.08 per cent. All the indices ended in the green, with services rallying 2.35 per cent, capital goods jumping 1.14 per cent, power (1.02 per cent), healthcare (0.90 per cent), oil & gas (0.85 per cent), energy (0.83 per cent), metal (0.80 per cent) and industrials (0.70 per cent). “After multiple attempts, the domestic market successfully managed to sustain record high levels, thanks to the increased buying interest in heavyweight stocks.

“The market’s bullish momentum was further supported by strong FII inflows and a narrowing current account deficit, both of which positively impacted investor sentiments. The gains were widespread, with the pharma and metal sectors leading the way as top performers, outshining other sectors,” said Vinod Nair, head (research) at Geojit Financial Services.

Foreign Institutional Investors (FIIs) bought equities worth Rs 2,024.05 crore on Tuesday, according to exchange data.

“It turned out to be an excellent session for bulls as Nifty touched a new milestone of 19,000 and gained nearly a per cent.